Introduction

XAG/USD Prices :In this article we will give you a good clarification about market reports. As you know that XAG/USD Prices are fluctuating up and down. We will clear out your all quaries here . Lets Start !!

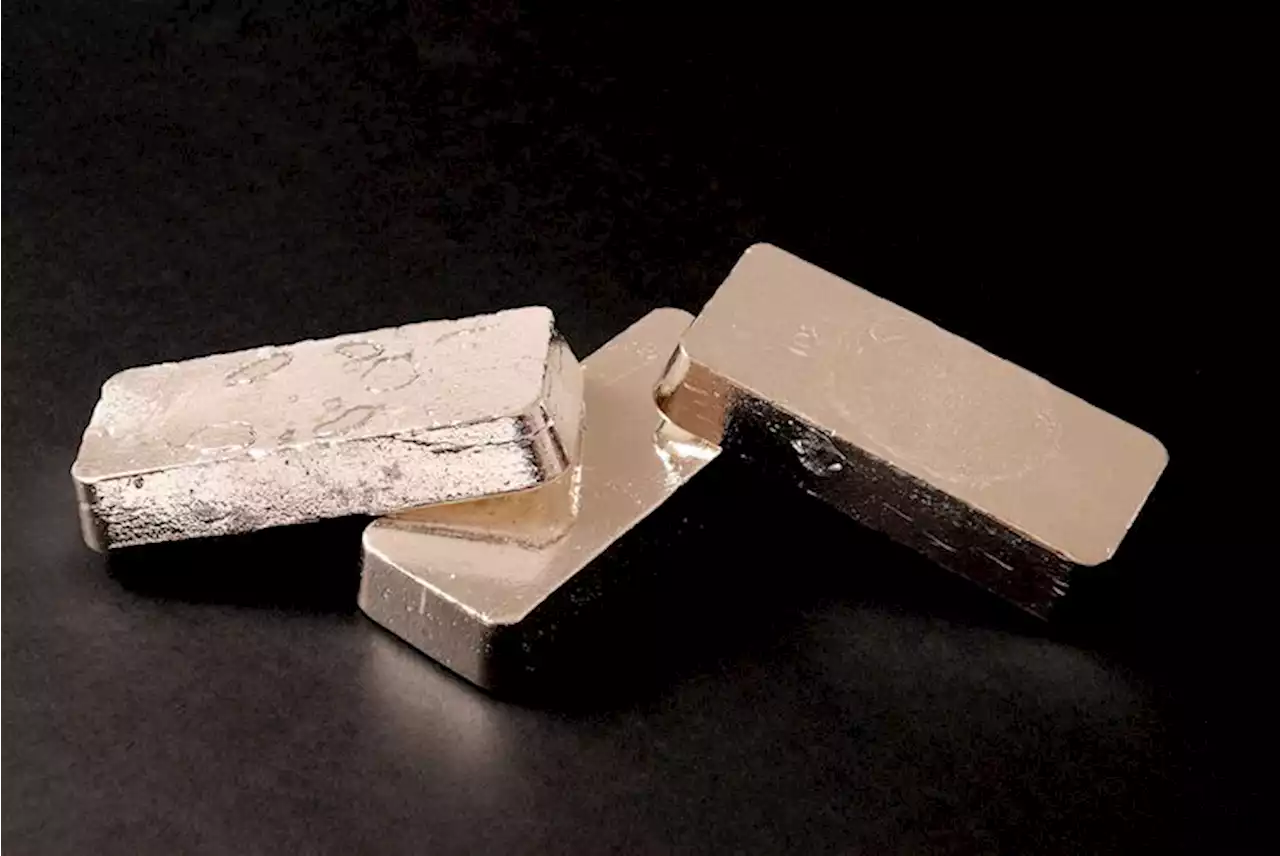

Silver prices have been followed for centuries. Silver (XAG) is a precious metal used in jewelry, silver, electronics, and coins. Silver prices are widely monitored in global financial markets. Silver has been in circulation for thousands of years and was once used to back coins. Silver remains one of the most traded commodities today. Silver prices are highly volatile due to speculation, supply and demand. Ag is the chemical symbol for silver in the periodic table and its ISO currency symbol is XAG.

| OVERVIEW | |

|---|---|

| Today last price | 18.82 |

| Today Daily Change | 0.17 |

| Today Daily Change % | 0.91 |

| Today daily open | 18.65 |

Overview

People also read 👉 :- The Top 10 Electric Vehicle Charging Station Contractors

A sustained break below $18.00 is seen as a new trigger for bearish traders.

silver gained traction for his second day in a row on Tuesday, looking to build on the recent rally from his more than two-week low around $18.00 touched on Friday. However, the white metal remains within the wider trading range of the previous day, breaking below the $19.00 round value. The

technical indicator on the daily.

- Silver price analysis: XAG/USD Prices closes to yesterday’s highs, with $19.00 in sight.

- Silver rises for a second day in a row but remains below $19.00.

- This setup is tricky for the bulls.

Hour chart has recovered from negative territory but has yet to confirm its bullish bias. Therefore, it is wise to wait for sustained movement beyond the above grip before engaging in another grateful movement positioning. After that, XAG/USD Prices may gain momentum towards the $19.70-$19.80 supply zone.

The psychological $20.00 level will soon follow and if it clears definitively, the short term negative bias will be reversed and a new wave of short cover action will begin. A subsequent move up could see the XAG/USD Prices pair test the intermediate hurdle at $20.50 and the barrier at $21.00-21.10 or the 200-day EMA.

On the upside, the Asian session low at the $18.60 area now appears to be defending the recent downside. Further declines could find support near $18.00, which should act as a fulcrum. A convincing descending break could leave XAG/USD Prices vulnerable and retest YTD lows around $17.55 before falling to the $17.00 level.

Market Levels

| LEVELS | |

|---|---|

| Previous Daily High | 18.94 |

| Previous Daily Low | 18.24 |

| Previous Weekly High | 20.19 |

| Previous Weekly Low | 18.09 |

| Previous Monthly High | 20.02 |

| Previous Monthly Low | 17.56 |

| Daily Fibonacci 38.2% | 18.67 |

| Daily Fibonacci 61.8% | 18.51 |

| Daily Pivot Point S1 | 18.28 |

| Daily Pivot Point S2 | 17.91 |

| Daily Pivot Point S3 | 17.58 |

| Daily Pivot Point R1 | 18.99 |

| Daily Pivot Point R2 | 19.32 |

| Daily Pivot Point R3 | 19.69 |

Market Trends

| TRENDS | |

|---|---|

| Daily SMA20 | 19.39 |

| Daily SMA50 | 19.29 |

| Daily SMA100 | 19.82 |

| Daily SMA200 | 21.79 |

Conclusion

The XAG/USD is the most popular way to trade silver, and it’s also the most liquid. The XAG/USD Prices trades in a range from $14 to $17 per ounce, with an average of $16. For investors who are looking for more volatility in their trading, the XAG/USD might not be the best choice. .The XAG/USD is usually the most liquid silver option, but it is also the least volatile.

Note :- We are not recommending any stocks or any currency, It’s only for educational purpose. Please do your own research before investing.

Frequently Asked Questions

Q1. What does XAG USD mean?

Ans:- XAG/USD is the abbreviation for the Silver and US Dollar pair.

Q2. Should I buy Gold or Silver?

Ans:- Silver is more volatile, cheaper and more related to the industrial economy. Gold is expensive and better for diversification of your overall portfolio. One or both may have a place in your portfolio. Arguably, the best use of gold as an investment is to reduce portfolio risk.

Q3. What is XAG rate?

Ans:- Convert Silver Ounce to US Dollar (XAG. USD. 1 XAG. 19.2945 USD).